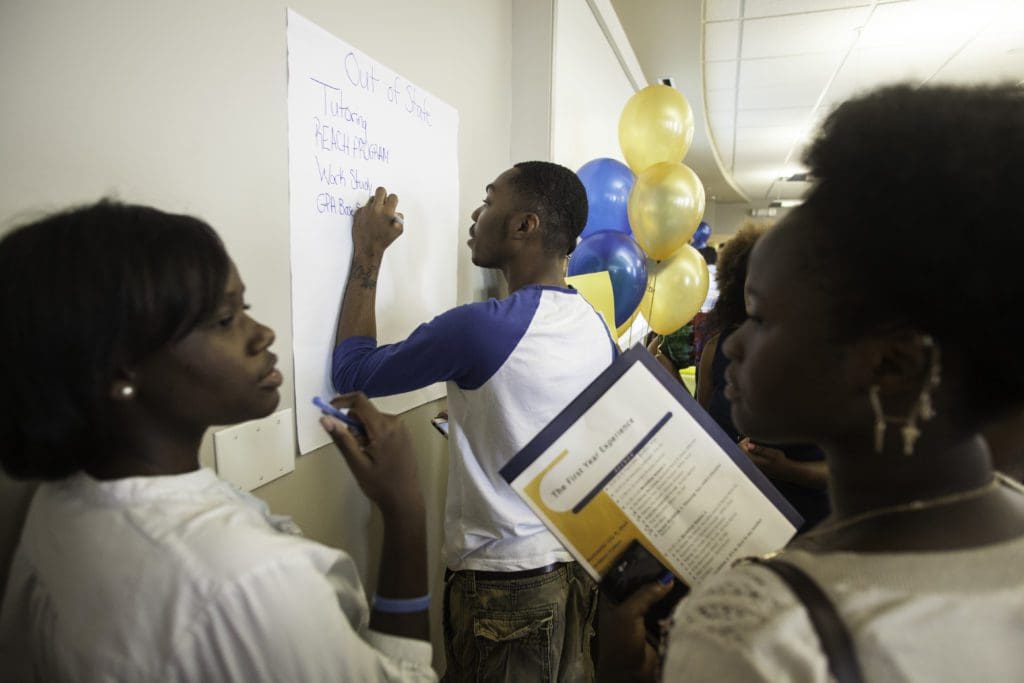

The Philadelphia Education Fund is approved as an Educational Improvement Organization (EIO) for 2022 under the Commonwealth of Pennsylvania’s Educational Improvement Tax Credit (EITC) Program. Qualified businesses can earn significant tax credits equal to 75%-90% of their contributions to approved EIOs. We are eligible to receive EITC contributions for our College Access Program and Philadelphia Postsecondary Success Program.

Don’t delay! If you would like to donate to PEF through your business’s Educational Improvement Tax Credit, please contact Alison Foster at afoster@philaedfund.org. It’s a win-win for your business and for Philadelphia’s low income high school students.